John Schroder received more votes that his fellow Republicans in the recent State Treasurer primary, which, in Louisiana, is tantamount to being elected.

He ran on a platform of fiscal restraint, cutting waste and fraud and fighting special interests.

But the job comes with little direct authority: the state treasurer monitors Louisiana’s investments, approves state construction projects and represents Louisiana on Wall Street. Before he was elected to the U.S. Senate, John Kennedy used the position effectively as a bully pulpit to criticize the taxing and spending policies of governors Jindal and Edwards. Schroder has said he intends to do the same.

A lot of bullying is needed. Louisiana is in a fiscal mess right now. By next July, the legislature must cut spending or raise taxes by $1.3 billion dollars to avoid the “fiscal cliff” — the point where the state runs out of money.

What can Schroder do as state treasurer to help the state through this crisis? For one thing, he can push for tax reform. As a legislator, Schroder was the key sponsor of legislation that created a blue-ribbon task force on tax reform last year. The group came up with proposals for putting the state on solid financial footing.

Although its recommendations were widely praised, Gov. Edwards ignored them. A few days before the last legislative session, he put forward his own tax plan — one that was destined to fail.

Tax reform is not about how much tax revenue the state raises; it is about how the state structures its taxes to raise its revenue.

Tax structure can make a huge difference in how government operates.

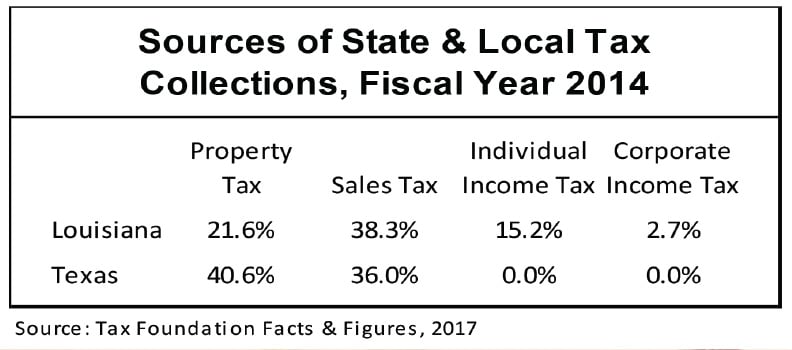

Compare Louisiana with our neighbor Texas. Texas has high property taxes, but no state or local income tax. Louisiana, on the other hand, has low property taxes and the highest sales tax in the nation. Moreover, Louisiana has the highest homestead exemption in the nation, which has essentially turned its property tax into a tax on capital that is very unequally distributed across communities.

State and local government in Louisiana raised $8,454 per capita in 2014, compared to $7,521 in Texas, so Louisiana was the higher tax state. But tax structure is about more than how much money the government raises; it has a great deal to do with how government operates and the way the political game is played.

For example, what do the tax structures of Texas and Louisiana tell us about how government operates in those states? The traditional tax base for local government is the property tax; state governments rely on the sales tax; and the federal government relies on the income tax. The tax structure in Louisiana tells me that we have a very centralized tax system with many functions that should be funded locally being funded by the state.

Moreover, Louisiana ranks second in the nation in reliance on federal funding, with our state government getting 40 percent of its revenue from Washington. In keeping with Russell Long’s dictum on taxation — “Don’t tax you, don’t tax me, tax the man behind the tree” — some Louisiana politicians say this is great because it means somebody else is paying for what the state is providing.

But remember that all those federal dollars come with federal mandates and regulations. So, the funding means Washington calls a lot of the shots in Baton Rouge.

This reliance on federal funds has an especially large impact on things like education (where Louisiana consistently ranks near the bottom), health care (where we also rank at the bottom), and infrastructure (I don’t know where we rank, but the roads and bridges in Texas sure seem better than ours).

The primary goal of tax reform should be to make government in Louisiana more transparent, responsible and accountable with our tax dollars. This means decentralizing our government.

Public services are best provided by government that is close to the people, rather than government far away. If local government is responsible for financing a service, voters are better able to hold government officials accountable for how their tax dollars are spent and vote them out of office if they aren’t doing a good job.

When tax revenue is centralized at the state level, you’re likely to get “pork-barrel” politics in which politicians see their job as “bringing back the bacon,” often funding projects local voters would never fund themselves, such as bridges to nowhere. (Ever been to the Sunshine Bridge?)

Taxes are not evil. A pledge of “no new taxes” is simply a way of saying, “I don’t trust the government to use the money wisely.” But taxes can be an more honest way of financing government than bureaucratic regulation, confiscation or debt.

I see local tax initiatives being passed by local voters all the time; in the recent election, a number of tax initiatives were passed in surrounding parishes.

But people in Louisiana don’t trust state government. In order for the state to get a tax passed by voters, it generally has to earmark the funds and constitutionally protect them so they aren’t plundered or used for other things by the politicians. That’s one of the reasons the state is in the fiscal mess it’s in; there are very few areas other than higher education and health care the state can cut from because everything else is constitutionally protected.

Before granting the state more revenue, we should insist on structural tax reform that will strengthen local government and make it less dependent on the legislature in Baton Rouge. If you aren’t certain how to make government work better, just ask yourself WWTD: “What Would Texas Do.”

Comments are closed.