By the time you read this, Congress will likely have worked out a last minute compromise to raise the ceiling on the national debt. We’ve been down this road before; the debt ceiling has been raised 74 times since 1962. The most recent increase was in 2011, when an impasse between Republicans and Democrats rattled financial markets (the Dow Jones Industrial Average fell 2,000 points) and led to the first-ever downgrade in the federal government’s credit rating.

But don’t confuse the debt ceiling with the partial shutdown of the federal government that is now in its 11th day. The shutdown is largely a joke. State and local governments provide most of the services that impact our daily lives, such as police and fire protection, schools and sanitation. If they were to shut down, we would feel the effects immediately.

The work of the federal bureaucracy, however, largely involves pushing paper and processing applications. Although the Obama administration has gone to absurd lengths to make us aware of the shutdown, like closing access to national monuments and turning off the panda cam at the national zoo, few people other than federal employees can say their lives have been affected in any meaningful way by the absence of federal services.

In terms of crises, the debt ceiling is the real deal. If Congress fails to raise the ceiling before Oct. 17, the federal government will be unable to borrow more money and will quickly run out of cash. This means it will be forced to delay making interest payments on the $17 trillion of outstanding bonds.

At a minimum, this will shake global confidence in the U.S. dollar and drive up bond rates, increasing the future cost of borrowing for the government. In a worst-case scenario, it will collapse the global monetary system that is built on debt and plunge us into a worldwide depression.

Why not simply raise the debt ceiling one more time? The dilemma is that going deeper and deeper into debt to finance federal spending isn’t sustainable in the long run. How long is the long run? Nobody knows when, but eventually we will run out of people willing to loan money to a nation with crumbling infrastructure, a ballooning bureaucracy, and anemic economic growth. So by raising the debt ceiling each time we bump up against it, we avoid an immediate crisis, but we create an even bigger crisis down the road.

It’s been proposed that we temporarily raise the debt ceiling to give Congress time to work out a long-term, bi-partisan plan to balance the budget. The problem is we’ve done that before and it didn’t work. After raising the debt ceiling in 2010, the bi-partisan National Commission on Fiscal Responsibility and Reform was created to identify spending cuts and revenue enhancements (that is, more taxes) sufficient to achieve fiscal sustainability. The commission produced a report, but nothing came of it because Democrats opposed the spending cuts while Republicans opposed the tax increases.

My solution would be to impose a ceiling on foreign borrowing by the federal government, while allowing it to borrow domestically to meet its obligations.

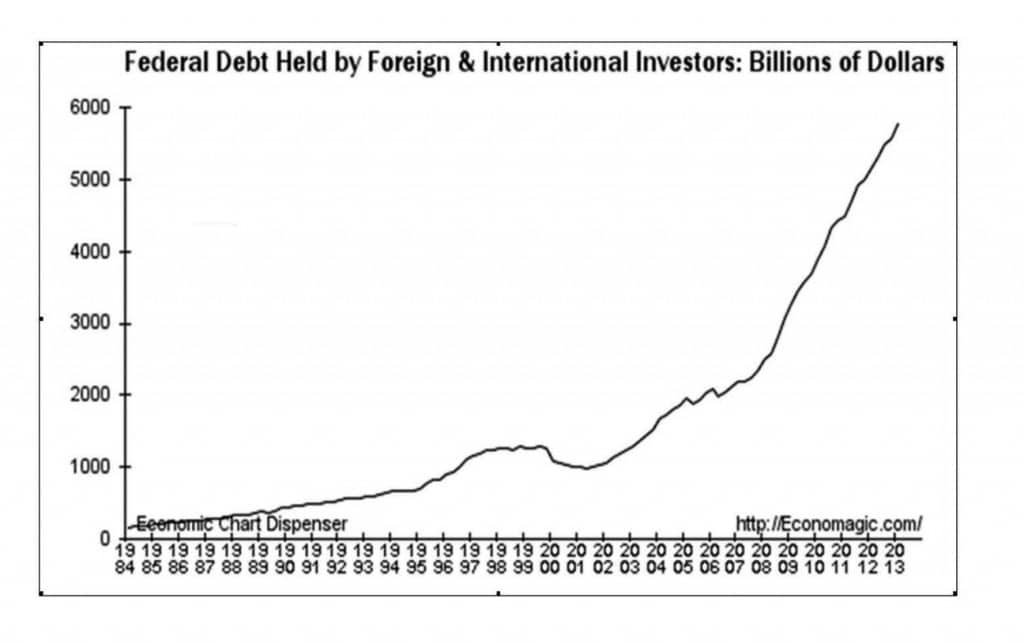

Six of the seventeen trillion dollars of federal debt is owed to foreign entities — about half of it to Japan and China (see the graph). One reason this situation is dangerous is that it places our economic health in the hands of countries that may not have our best interest at heart. Another reason is that it enables the unnecessary and unproductive expansion of federal programs by eliminating the political cost of government spending.

Forcing the federal government to borrow domestically would constrain the growth of the federal government, because additional spending would require either raising of taxes or borrowing in domestic markets. This would drive up interest rates or, if the Federal Reserve bought the bonds, lead to money creation and inflation. Any of these options would meet with voter resistance.

This is what happened during the “stagflation” (slow growth and rising prices) of the 1970s when angry voters elected Ronald Reagan in 1980.

As long as the federal government can finance its operations by selling bonds to buyers overseas, such as the Chinese, politicians perceive no cost to expanding government. But what happens when the Chinese decide to cash in their U.S. bonds? That’s the real ticking time bomb.

Comments are closed.